Salary Options:

Salary Calculator:

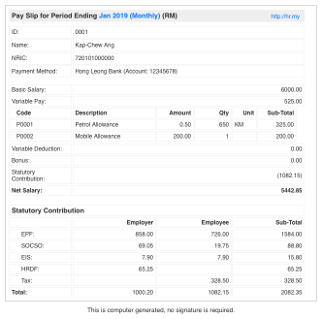

1. If you need more flexible and better payroll calculation, such as generating EA Form automatically or adding allowance that does not contribute to PCB, EPF or SOCSO, you may want to check out HR.my - Free Malaysian Payroll and HR Software, which is absolutely FREE! Forever for UNLIMITED employees. BTW, Payroll.my PCB calculator 2025 is powered by HR.my's payroll calculator.  On top of a powerful payroll calculator, HR.my also offers Paperless HR:

On top of a powerful payroll calculator, HR.my also offers Paperless HR:

2. Employee Salary plus any other allowances.

3. Calculation for bonus tax:

8. Calculation of yearly income tax for assessment year 2024:

10. Contact me for support.

On top of a powerful payroll calculator, HR.my also offers Paperless HR:

On top of a powerful payroll calculator, HR.my also offers Paperless HR:

- FREE Leave Management which allows your employees to apply and check leave balance online

- FREE Expense Claim Management which allows your employees to submit expense claims anywhere, anytime on any device

- FREE Time Clock and Attendance Management that simplify employees' clock-in or clock-out anywhere, anytime on any device. Plus, there is also a Field Check-In feature for tracking mobile sales force's locations easily

- FREE Document Workflow to allow online submission of purchase requests, OT requests, stationery requests etc.

- All leave, expense claim and document workflows support up to 3 levels of approver, such as Line Manager, Head of Department or Branch, or any custom approvers like Boss, Director etc. FREE!

- FREE Online Document Sharing, Discussion Forum and many more that you will have to see it for yourself. Most importantly, new features are being added every month for FREE!

2. Employee Salary plus any other allowances.

3. Calculation for bonus tax:

- If you wish to ONLY calculate the PCB for bonus of an employee with monthly salary, you will still need to enter the monthly salary of the employee even if the bonus is paid at a different date. This will calculate the combined tax for both salary and bonus in the payslip, after that you may deduct the tax of the monthly salary component to get the bonus-only tax. E.g. if monthly salary is RM 5,000, with a yearly bonus of RM 5,000, then for an employee who is not married, the combined tax for both salary and bonus is RM 650. For the same employee, monthly PCB for salary alone will be RM 130, so the tax for bonus is RM 650 - RM 130 = RM 520.

- Alternatively, you may change the Calculate For option to Bonus Only, this will show the exact amount of statutory contributions for the bonus component only.

- Jadual PCB 2025 / PCB Table 2018

- EPF Contribution Third Schedule

- SOCSO Contribution Table

- Caruman SIP / EIS Table

- EPF contributions tax relief up to RM4,000 (this is already taken into consideration by the salary calculator)

- Life insurance premiums and takaful relief up to RM3,000

- National Education Savings Scheme (SSPN) relief up to RM8,000

- Education and Medical Insurance up to RM 3,000

- Tax Deduction For Lifestyle up to RM 2,500

- Medical Treatment, Special Needs or Carer Expenses of Parents up to RM 5,000

- Higher Education Fees (Self) up to RM 7,000

- or other approved deductions

- According to KWSP: Employers are not allowed to calculate the employer’s and employee’s share based on exact percentage EXCEPT for salaries that exceed RM20,000.00. The total contribution which includes cents shall be rounded to the next ringgit.

- For employees who receive wages/salary of RM5,000 and below, the portion of employee's contribution is 11% of their monthly salary while the employer contributes 13%. For employees who receive wages/salary exceeding RM5,000 the employee's contribution of 11% remains, while the employer's contribution is 12%.

- Where the employer pays bonus to an employee who receives monthly wages of RM5,000.00 and below, and upon receiving the said bonus renders the wages received for that month to exceed RM5,000.00, the employer’s contribution shall be calculated at the rate of 13% of the amount of wages for the month.

- The minimum Employers’ share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four (4) per cent per month, while the Employees’ share of contribution rate will be zero per cent.

- Wages or Salary Payment Subject to EPF Contribution

8. Calculation of yearly income tax for assessment year 2024:

- If you need to check total tax payable for assessment year 2024, just enter your 2024 yearly income into the Bonus field (leave Salary field empty), and enter whatever allowable deductions for 2024 to calculate the total amount of tax for 2024. Don't forget to change PCB year to 2024.

- Likewise, if you need to estimate your yearly income tax for 2025 (i.e. assessment year 2025), just do the same as previous step with your estimated 2025 total income, but choose 2025 for PCB year.

10. Contact me for support.